Unlocking Venture Investing: A Beginner's Guide to Raison

Written on

Chapter 1: Introduction to Raison

Have you ever wondered why venture capital investing is not as readily available to the general public as regular stock market trading? It often seems out of reach due to the substantial capital required and the need for accredited status. However, I recently discovered an app that claims to change this dynamic, allowing investments to start from as little as $1.

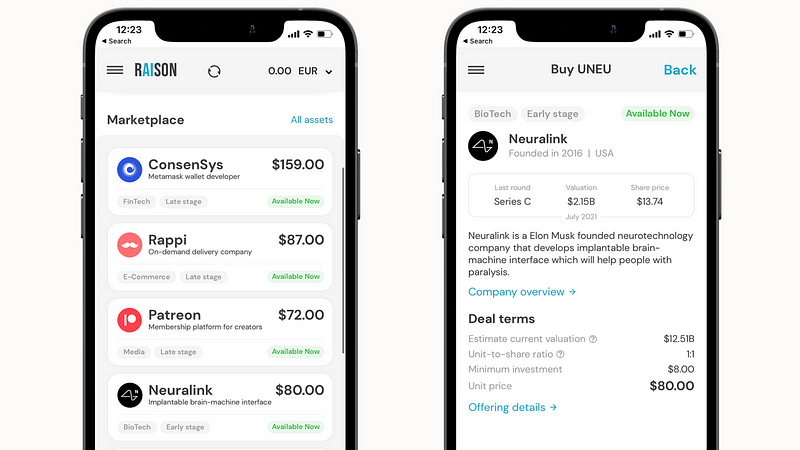

Meet Raison. This innovative investment app provides users with access to premier late-stage venture investment opportunities. By leveraging blockchain technology, Raison facilitates fractional share investments, making it easier and safer for individuals to participate in the venture investing landscape.

Raison operates through a specialized investment fund, managed by Raison Asset Management, which is regulated by the US SEC. This fund acquires shares from significant companies and offers them on their platform in smaller fractions, thus reducing the barriers for individuals eager to invest in top private firms like SpaceX and Neuralink.

Chapter 2: A Quick History of Raison

Raison began its journey in 2019, initially offering shares of SpaceX. This launch was met with great success, prompting the app to expand its offerings to include other high-profile private companies like Klarna, Patreon, and Neuralink. Since then, Raison has continued to thrive, with several companies listed on their platform eventually going public, rewarding users with substantial profits. Notable examples include Airbnb and DigitalOcean.

In the same year Raison debuted, it was recognized by TechCrunch as one of the top five fintech startups. Its user base has grown impressively, now boasting around 22,000 users worldwide, a testament to its appeal and effectiveness. To ensure user confidence, Raison operates under the regulatory oversight of the US SEC.

Section 2.1: The Appeal of Venture Investing

You might be curious about what sets venture investing apart. Traditionally, it has been limited to accredited investors, requiring significant capital, making it a domain reserved for wealthy individuals or venture capital firms. However, Raison has transformed this landscape, allowing anyone to invest in promising private companies for as little as $1. This opportunity is particularly enticing as these firms are meticulously chosen by financial analysts based on their growth potential.

Investing at this stage offers a unique chance to engage with companies while they are still emerging, often before they reach public markets. It's an exciting way to support innovative businesses that are poised to shape our future.

Section 2.2: How Raison Works

After downloading the Raison app and completing the registration process, users can browse available shares on the platform. However, it's essential to act quickly, as shares tend to sell out fast. Personally, I'm keeping an eye on Neuralink, as I believe it has the potential to be a game changer.

Once you choose a company for investment, you can start with as little as 0.1 of a share. The platform also allows for diversification, enabling users to build a balanced portfolio across various companies.

Chapter 3: Understanding Profits and Exit Strategies

A common concern among potential investors is how to profit from pre-IPO investments and what happens if a company doesn’t go public. Here's the breakdown: you can profit if the company's value rises through funding rounds or when it goes public and triggers an exit event. Raison's app allows you to monitor the stages of the companies you invest in, and it boasts a user-friendly interface.

What if the company never goes public? Not to worry—Raison plans to introduce a secondary marketplace where you can sell your shares. These strategies are generally categorized as exit strategies. In essence, when you purchase shares through Raison, you can either wait for the company to list publicly and complete its lock-up period or sell your shares on the secondary market, currently in beta testing.

My Final Thoughts

I truly believe Raison presents a remarkable opportunity for investors to engage with some of the most promising private companies before their IPOs, all at an accessible entry point. This app has addressed my long-standing question about the absence of platforms offering pre-IPO investment opportunities.

For further insights about Raison, you can visit their:

- Website: Raison.ai

- Twitter: Raisonapp

- Instagram: Raisonapp

- YouTube: Raison app

I hope you found this article informative. If you’re interested in more tech-related topics, updates, and personal insights, feel free to follow along.

If you’d like to support my work further, there’s a tip button below, which will assist me in upgrading my equipment for better content quality.

Thank you,

Abraham

Explore the best investing app for beginners in 2024 with this complete guide.

Discover the four best investing apps for beginners in 2024 and how to maximize your investment potential.