Understanding Fast's Demise: Lessons from a Failed Checkout Startup

Written on

Chapter 1: The Rise and Fall of Fast

Fast, a once-prominent startup specializing in one-click checkout solutions, declared bankruptcy on April 5th. Backed by Stripe, its failure provides important insights for entrepreneurs and investors alike.

Failure serves as a significant teacher, and Fast's story exemplifies this.

Section 1.1: The Basics of Fast's Business Model

Founded in March 2019 by the dynamic Domm Holland and Allison Barr Allen, Fast aimed to revolutionize online shopping by providing a seamless checkout experience. The company garnered over $120 million in funding and reached a valuation of $580 million, attracting notable investors like Stripe, Index Ventures, and Kleiner Perkins.

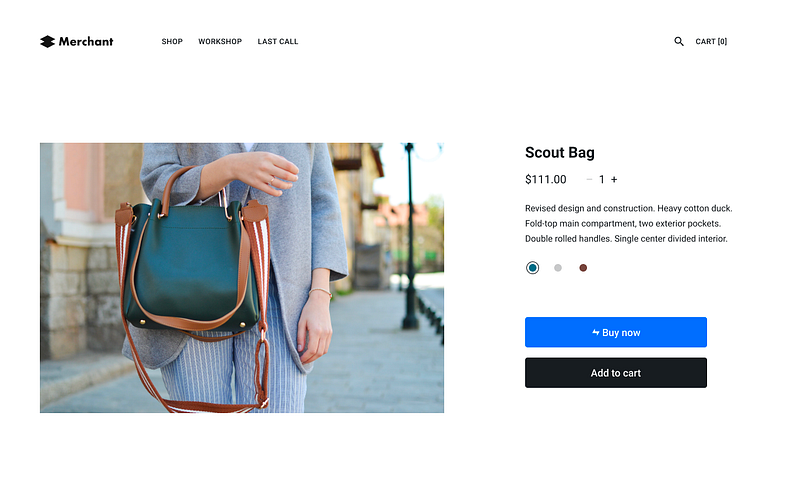

Fast's objective was to replicate Amazon's successful one-click checkout across the web. Launching in September 2020 with 100 merchants, the platform allowed customers to input their payment and shipping details just once, enabling a frictionless checkout experience with a single click thereafter.

Despite this innovative approach, Fast faced stiff competition in a crowded market filled with established players like Apple and PayPal, as well as rising startups such as Bolt and Checkout.com.

Living Autopsy: What Happens During a Post-Mortem? (Full lecture) - This video delves into the importance of examining failures, drawing parallels to Fast's demise.

Section 1.2: The Mechanics of Checkout

Fast's checkout solution aimed to minimize customer frustration, allowing shoppers to complete transactions directly from product pages. This led to over 50% of checkouts occurring without traditional checkout flows. By integrating with merchants' backend systems, Fast also facilitated post-purchase order additions, enhancing upsell opportunities.

Despite the appeal of one-click checkout, Fast's financial metrics raised concerns. The startup's strategy focused on small and medium-sized businesses, necessitating a robust self-service model that it failed to provide.

Chapter 2: The Financial Struggles of Fast

Rapid Fire Questions with Fit For An Autopsy • MetalSucks - This video explores the rapid questioning style, much like the fast-paced decisions that led to Fast's downfall.

Fast's business model was straightforward: charging merchants a fee based on payment volume. However, the company struggled to achieve the scale necessary for sustainability. Reports indicated an alarming cash burn of $10 million per month by late 2021, driven by an expanding workforce and extravagant spending.

The stark contrast between Fast's minimal revenue and excessive expenses highlighted the unsustainable nature of its operations. To achieve breakeven, Fast needed to process 1.5 million to 1.8 million orders monthly, a far cry from the mere 90,000 to 110,000 orders it managed in 2021.

Section 2.1: The Lessons Learned from Fast's Demise

Fast's downfall offers several takeaways for both investors and entrepreneurs:

- Healthy Skepticism is Crucial: Claims of rapid growth require solid evidence. The absence of hard numbers should raise red flags.

- Beware of Hero Worship: Even high-profile investors can make mistakes. Successful backing does not guarantee a startup's viability.

- Understanding Investor Dynamics: Strategic investors may have differing goals from financial investors, which can impact decision-making.

- Revenue vs. Expenses: What looks feasible on paper can often prove challenging in practice.

- Market Cycles Matter: The shifting tides of investment climate can dramatically affect a startup's fortunes.

Fast's story is a cautionary tale about the perils of rapid expansion without sustainable growth strategies and serves as a reminder of the importance of rigorous financial management.