Navigating Cryptocurrency Cycles: Insights from Fred Ehrsam

Written on

Understanding Cryptocurrency Cycles

Fred Ehrsam, co-founder of Coinbase, shares his decade-long expertise on navigating the ups and downs of cryptocurrency markets to help you develop a robust strategy.

"In 2013, during the cryptocurrency downturn, 30% of my team left, which felt incredibly isolating," recalls Ehrsam. Coinbase, which began in a modest apartment by two friends, has become the leading cryptocurrency firm in the United States. At just 24, Ehrsam and Brian Armstrong launched a company that would later make its stock market debut with a valuation exceeding $100 billion. Despite his ties to Coinbase, Ehrsam now leads his own Web3 investment venture, Paradigm, where he reflects on past bear markets.

Ehrsam emphasizes a key principle: during prosperous times, things are never as fantastic as they appear, and during downturns, they are seldom as dismal. While the current market situation is uncertain, historical trends indicate that each downturn ultimately strengthens the cryptocurrency sector.

Fred Ehrsam:

“Market cycles are natural; neither entirely positive nor negative. Periods of extreme optimism allow for visionary thinking, while deep despair cultivates realism and pragmatism.”

Ehrsam has witnessed three major market cycles in 2011, 2013, and 2017, navigating euphoric peaks followed by significant downturns. By learning from his experiences, you can sidestep common pitfalls and enhance your chances of success.

The Nature of Cycles

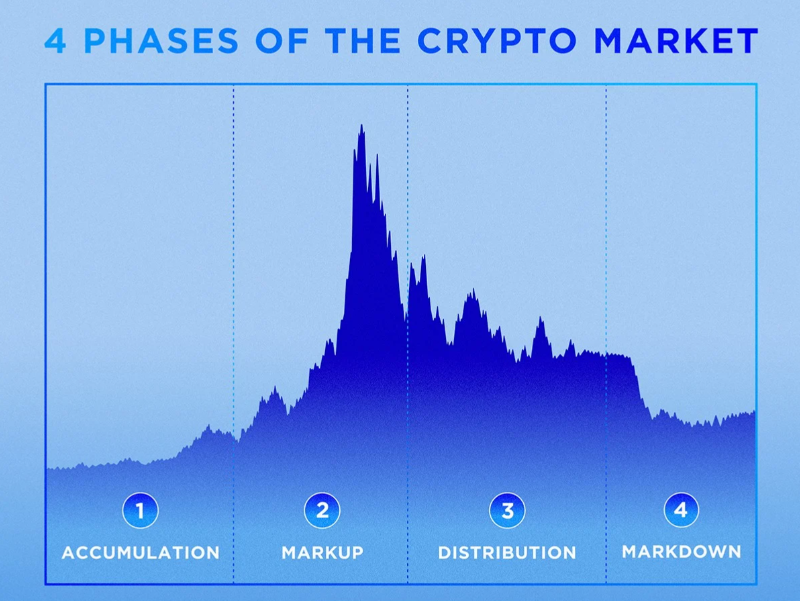

Cryptocurrency markets are inherently cyclical, typically following a predictable pattern of highs and lows. A coin's value tends to rise when demand exceeds supply, but interest eventually wanes, leading to price declines. This rise and fall encapsulate a single cycle, which generally unfolds over four distinct stages across four years:

- Accumulation (Low Volume)

- Mark Up (High Volume with New Investors)

- Distribution (Transition from Buyers to Sellers)

- Mark Down (Negative Market Sentiment)

Ehrsam contends that while future predictions are impossible, historical cycles can provide insights into potential outcomes, allowing one to prepare for inevitable volatility.

Fred Ehrsam:

“Although we can't foresee the future, previous cycles offer clues on what to expect. They remind us to brace for bouts of uncertainty and volatility.”

Insights from Historical Cycles

While cycles do not repeat identically, they share commonalities. Ehrsam identifies four recurring themes during market fluctuations:

- Emotional Responses: Investors often struggle to maintain rationality amid significant financial gains or losses. Historical evidence suggests that hype phases are brief, while prolonged downturns are more common. In 2013, Ehrsam lost many team members to despair, reinforcing the emotional toll of market volatility.

- Ecosystem Strengthening: Each cycle leaves the cryptocurrency landscape more resilient than before, particularly over a five-year view. Despite the apparent chaos, adoption rates generally trend upwards.

- Elimination of Weak Projects: Downturns serve as a litmus test for weaker projects, often leading to their exit from the market.

- Building Resilience: Predicting market specifics is challenging, which makes personal resilience crucial. Ehrsam suggests that independent thinking during periods of euphoria or despair is vital.

Fred Ehrsam:

“Sometimes, insights from others can aid your thought process. My experience has shown that preparation for a long journey, rather than a quick sprint, eases the challenges of market fluctuations.”

Final Considerations

Ehrsam underscores the importance of having a guiding framework to navigate the complexities of an evolving market. The greatest opportunities often arise from uncertainty; if cryptocurrency were seen as entirely predictable, the potential for gain would diminish.

By using the four stages of the cryptocurrency cycle as a foundation for your strategy, you can seize opportunities that arise in this dynamic environment.

To delve deeper into Web3 insights, consider becoming a member, which directly supports writers you appreciate. If you join through my link, I will earn a small commission.

Disclaimer: This article is meant for informational purposes and should not be viewed as financial, tax, or legal advice. Consult a financial professional before making significant financial decisions.