Navigating Stock Market Bubbles: Avoiding Costly Investor Assumptions

Written on

Understanding Stock Market Bubbles

The current economic climate is troubling, with inflation soaring and stock markets experiencing significant downturns, largely attributed to geopolitical tensions, particularly the conflict in Ukraine. As many investors have entered the market at its peak, the tendency to cling to these investments—despite their decline—becomes prevalent. This behavioral pattern, known as loss aversion, affects both novice and seasoned investors alike.

The Consequences of Misjudgment

Vladimir Putin's ambition to restore the Soviet Empire has faced significant challenges in Ukraine. The anticipated swift takeover has devolved into a protracted conflict, with fierce resistance from the Ukrainian populace and severe economic sanctions imposed on Russia. Rather than retreating from his miscalculations, Putin seems determined to persist, a mindset that mirrors the psychological traps investors can fall into during market downturns.

Assumption 1: A Quick Resolution

Putin believed the invasion would conclude rapidly, but reality has proven otherwise. Similarly, investors often assume that a declining stock will rebound swiftly, especially if they've previously experienced quick recoveries. However, history shows that significant market corrections can take years to resolve, as seen during Japan's economic bubble in the early 90s. If you've purchased stocks at inflated prices, it's crucial to reassess your position realistically and avoid the pitfall of confirmation bias.

Assumption 2: Comprehensive Consideration

Putin miscalculated numerous factors in his invasion strategy, believing he had accounted for every possible outcome. Similarly, investors often overestimate their ability to foresee market movements. Strategies like dollar-cost averaging may work in stable markets but can exacerbate losses in a declining bubble economy. The unprecedented liquidity injected into the economy by the Federal Reserve is a significant factor in the current market overvaluation, making it vital to conduct a thorough analysis of your investments.

Assumption 3: Government Intervention

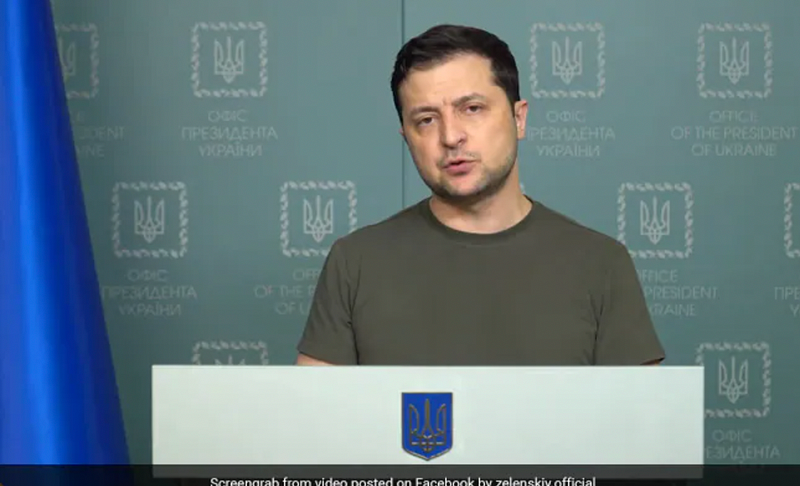

Putin anticipated a swift capitulation from the Ukrainian government, but President Zelenskyy and his compatriots have shown remarkable resolve. Investors might similarly believe that government or Federal Reserve actions will stabilize the market, but the reality is that these entities are not responsible for rescuing individual investments. The government's role is not to support stock prices but to maintain economic stability.

Assumption 4: Universal Demand

Putin assumed global reliance on Russian oil would ensure compliance from other nations; however, the ongoing embargoes demonstrate the fallacy in that thinking. Similarly, investors may believe that their company's product is indispensable, but if the market is deflating, even strong companies can miss earnings forecasts, leading to steep declines in stock prices. It's essential to remain vigilant and reassess your investments rather than succumb to loss aversion.

Chapter 2: Video Insights on Market Bubbles

Understanding the dynamics of stock market bubbles is crucial for informed investment decisions. Below are two insightful videos that delve deeper into this topic.

The first video, "Is The Stock Market Bubble Finally Popping?" discusses the signs that may indicate a significant market correction and what investors should be aware of.

The second video, "This Stock Market Bubble Might Never Pop!" explores contrasting perspectives on the longevity of the current market bubble and its implications for investors.

In conclusion, investors must be aware of the pitfalls of assumption during turbulent times. Seeking professional advice is essential for protecting your investments and navigating the complexities of the market.